In various fields, certain individuals shine brighter than the rest, leaving an indelible mark on their domain. While some arenas resist objective evaluation, domains like sports, book sales, and investing returns boast unmistakable results. Here, we celebrate eight exceptional investors whose prowess has inspired enthusiasts worldwide.

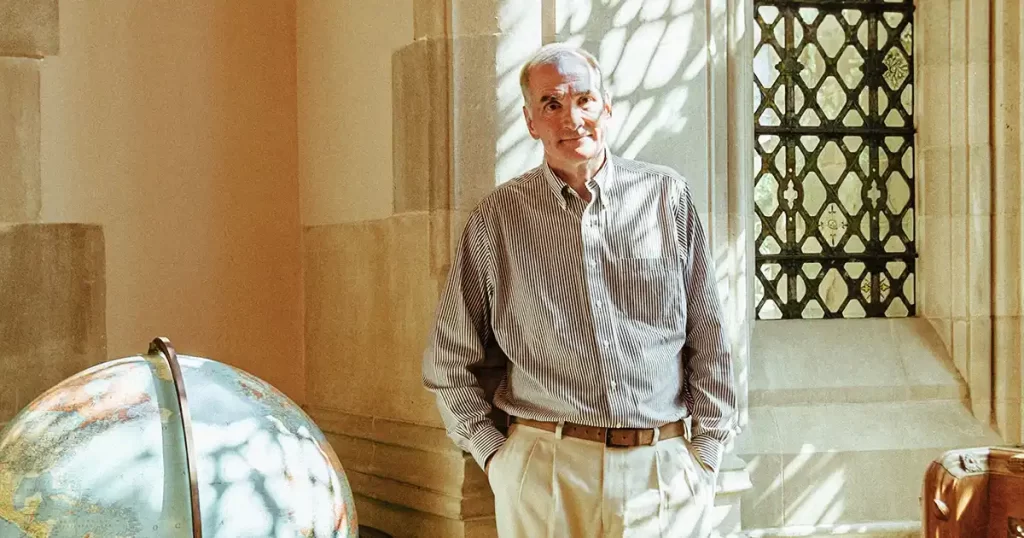

David Swensen: Master of Modern Portfolio Theory

As the CIO of Yale University, David Swensen’s financial acumen stands unparalleled. Over 36 years, until his passing in 2021, Swensen amplified Yale’s endowment at a remarkable compound annual growth rate of 13.7%. This outpaced the average university endowment by 3.4 percentage points each year. Employing modern portfolio theory, Swensen diversified asset exposure brilliantly, yielding remarkable success. His approach is brilliantly detailed in his timeless book, “Pioneering Portfolio Management.”

Peter Lynch: The Magellan Marvel

Peter Lynch not only delivered astounding returns at Fidelity’s Magellan Fund but also authored two seminal investing books. During his 13-year tenure, the fund soared at an annual rate of 29.2%, outshining the S&P 500’s average return of 15.8%. Magellan’s growth, from $18 million to $14 billion, exemplifies Lynch’s prowess. A $10,000 investment in 1977 would have multiplied to $280,000 upon Lynch’s retirement.

John Templeton: A Visionary Path

Diversified mutual funds saw a pioneer in John Templeton, who consistently achieved remarkable returns across 60 years. Templeton’s $10,000 investment in 1939, focusing on stocks under $1, led to astonishing success. In 1954, $10,000 in the Templeton Growth Fund became a staggering $2 million by 1992. Templeton’s legacy endures even after his passing in 2008.

Bill Miller: Unconventional Value Genius

Bill Miller’s feat is remarkable: his Legg Mason Value Trust outperformed the S&P 500 every year over a 15-year span (1991-2005). His growth from $750 million to over $20 billion in assets under management between 1990 and 2006 is a testament to his unique value investing philosophy. Miller’s belief in value-priced high-growth stocks yielded exceptional results.

Warren Buffett: The Unrivaled Oracle

Warren Buffett’s prowess has etched him into investing history as arguably the finest ever. Since 1965, he steered Berkshire Hathaway with an astounding 19.8% annual return, dwarfing the S&P 500’s 9.9% average. His remarkable returns, consistently delivered over decades, have translated into extraordinary shareholder wealth, with Berkshire Hathaway advancing 3,787,464% compared to the S&P 500’s 24,708% from 1965 to 2022.

Kirk Kerkorian: From Pilot to Powerhouse

Kirk Kerkorian’s journey from a pilot to an investing legend is awe-inspiring. His ventures in aviation and subsequent foray into Las Vegas and Hollywood, acquiring MGM among others, exemplify his strategic brilliance. Kerkorian’s worth reached around $4 billion by his passing in 2015, marking his profound impact.

Jack Bogle: Vanguard’s Index Innovator

Jack Bogle revolutionized investing by pioneering the low-cost index fund. His idea, brought to life through The Vanguard Group, introduced a passive approach aiming to mirror benchmark indexes. Vanguard’s success, boasting over 430 funds globally and $7 trillion in assets under management, is a testament to Bogle’s visionary leadership.

Jerry Buss: From Humble Beginnings to Sporting Glory

Jerry Buss, like Kerkorian, hails from humble origins. Starting with a 14-unit apartment building, Buss catapulted his real estate business to $350 million within 18 years. His legacy extended to sports ownership, including the LA Lakers and Kings. Buss’s net worth reached around $600 million by his passing in 2013.

These investing giants transcend mere numbers, shaping the very landscape of finance. Their extraordinary insights, strategies, and unwavering determination are a beacon of inspiration for investors around the world. As we delve into their remarkable journeys, we’re reminded that with dedication and foresight, financial greatness can indeed be achieved.